💥 BLACK FRIDAY

TAX SOFTWARE DEAL ONLY $99!

Launch or upgrade your tax business today with professional IRS-authorized software trusted by hundreds of preparers.

✅ IRS E-File Ready

💻 Cloud Access – Work Anywhere

🧾 Free Setup & Training

Limited-Time Black Friday Savings

Regular Price $1785, Now Only $99!

Join Our Team!

Tax Preparation Course Plus Free Professional Tax Software for any Tax Business OR Start up!

TEP provides you with all the tools needed, it truly is a one-stop-shop for all your tax business needs or for those looking to start a professional Tax Business…

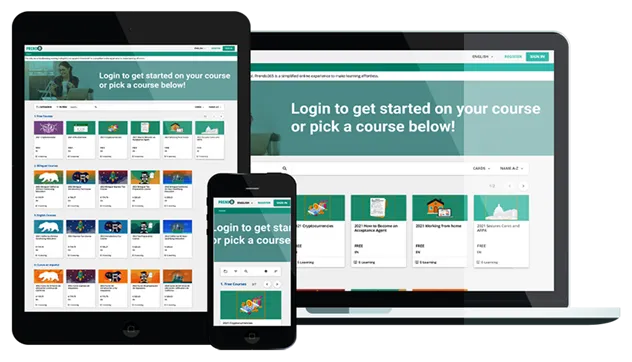

Web-based Software

Prepare tax returns from anywhere.

Prepare individual and small business returns from anywhere.

Tax Express Pro

Our Packages

limited time offer!

Pro Package: $1750

now $899!

This package is for Tax professionals to keep 100% of their preparation fees with low bank fees.

This package includes the following:

✓......PTIN / EFIN required.

✓......Professional tax software, including Federal and all 50 states.

✓......Three prior-year software.

✓......Year-round, live-person support.

✓......Bank products: print checks and issue debit cards on-site.

✓......$7000 preseason advances, at no cost to the tax preparer, repaid through taxpayer's refund.

✓......Start up office loan.

✓......No revenue split (For EFIN Holders Minimum of 30 Tax returns Preparation Required)

✓......Marketing materials for your tax preparation business

✓......Lead Generation software Free for 1 month

✓......Website design for your Business (Available for a Fee)

✓......Complete Tax preparation Business registration kits and EIN (Available for a Fee)

limited time offer!

Pro Package: $1785

now $99!

This package includes the following:

✓......PTIN required.

✓......Professional tax software, including Federal and all 50 states.

✓......Three prior-year software.

✓......Year-round, live-person support.

✓......Bank products: print checks and issue debit cards on-site.

✓......$7000 preseason advances, at no cost to the tax preparer, repaid through taxpayer's refund.

✓......Start up office loan.

✓ No revenue split (For EFIN Holders Minimum of 11 Tax returns Preparation Required)

✓,Marketing materials for your tax preparation business

✓,Lead Generation software Free for 1 month

✓,,,Website design for your Business (Available for a Fee)

✓,Website, design for your Business (Add-On)

limited time offer!

Pro Starter Package: $1849

now $1599!

Tax Preparation Course plus Free Professional Tax Software

This package gives you the knowledge needed to fulfill IRS requirements. It gives you a basic understanding of tax law and practices to ensure you serve your clients with the highest quality. The study materials provide line-by-line instructions for Form 1040.

This package includes the following:

✓......PTIN Required.

✓...Free Tax Preparation Course

✓......Tax preparer training on professional tax software

✓......Professional tax software, including Federal and all 50 states.

✓......Three prior-year software

✓......$7000 preseason advances, at no cost to the taxpayer, repaid through taxpayer's refund

✓......Bank products: print checks and issue debit cards on-site

✓......Each tax return reviewed

✓......In season, live-person support

✓......Private group to answer all your tax questions

✓......Startup office Loan

✓......No revenue split (Minimum of 7 Tax returns Preparation Required)

✓......Marketing materials for your tax preparation business

✓......Website design for your Business (Available for a Fee)

✓......Complete Tax preparation Business registration kits and EIN (Available for a Fee)

limited time offer!

Big Boss Complete package: $10999

now $5999!

Tax Preparation Course, Free Tax Software, Website and Business registration in your State!

This package has everything to fully build up a successful tax business for you with less stress. This package gives you the knowledge needed to fulfill IRS requirements. It gives you a basic understanding of tax law and practices to ensure you serve your clients with the highest quality. The study materials provide line-by-line instructions for Form 1040.

This package includes the following:

✓......IRS registration assistance with PTIN and/or EFIN applications

✓.....Free Complete Tax preparation Business registration kits and EIN Plus State Fees

✓......Professional tax software, including Federal and all 50 states. Three prior-year software

✓,,,,,,Tax Preparer Training on Professional Tax Software

✓......Weekly coach/private group to answer all your tax questions

✓......$7000 preseason advances, at no cost to the tax preparer, repaid through taxpayer's refund

✓......Bank products: print checks and issue debit cards on-site, Each tax return reviewed

✓......Year-round, live-person support

✓......Office start-up loan

✓......70/30 revenue split

✓......Website design for your Business

✓......Lead Generation Software Free for 6 Month

limited time offer!

Big Boss Complete package: $10999

now $5999!

Tax Preparation Course, Free Tax Software, Website and Business registration in your State!

This package has everything to fully build up a successful tax business for you with less stress.

This package gives you the knowledge needed to fulfill IRS requirements. It gives you a basic understanding of tax law and practices to ensure you serve your clients with the highest quality. The study materials provide line-by-line instructions for Form 1040.

This package includes the following:

✓......IRS registration assistance with PTIN and/or EFIN applications, Tax Preparation Course

✓..Free Complete Tax preparation Business registration kits and EIN, No State Fees

✓......Professional tax software, including Federal and all 50 states. Three prior-year software

✓,,,,,,Tax Preparer Training on Professional Tax Software

✓......Weekly coach/private group to answer all your tax questions

✓......$7000 preseason advances, at no cost to the tax preparer, repaid through taxpayer's refund

✓......Bank products: print checks and issue debit cards on-site, Each tax return reviewed

✓......Year-round, live-person support

✓......Office start-up loan

✓....Website design for your Business

✓....Website design for your Business

✓.Lead Generation Software Free for 6 Month

limited time offer!

PAYMENT PLAN AVAILABLE !

7 figures Package support : $15000

now $6750!

GROW YOUR BUSINESS

This package help you you grow your Tax Business with a complete support system

This package includes the following:

✓..Tax preparation course and Free Tax Software

✓......Free Tax Software for PTIN Holders (no minimum requirement) for EFIN (7 minimum clients).

✓.....Free Website Design and Hosting

✓.....Marketing intensive offer to you clients to attract more clients at no cost to you

✓.....Your unique Portal

✓ .....Weekly coach/private group to answer all your tax questions in Tax season

✓ .....Lead Generation Software Free for 1 years

limited time offer!

PAYMENT PLAN AVAILABLE!

Professional Website Design: $2500

now ONLY FOR $999!

FREE HOSTING

Professional Website Design

Your unique online representation

Get your business online for Only $999 with Free Website Hosting, Free Domain Name For Accountants, Bookkeepers and Tax Professionals

Our Premium Deluxe Website Package is the perfect way to launch your online presence in a big way.

For just $999, you'll get a professionally designed website, a custom Free domain name, secure Free hosting, and all the essential features you need to succeed. This package is more than just a basic website - it's a powerful foundation for your digital success.

Fast, Simple and affordable business Website For:

LLC, Corporations, Non-Profits, DBA, Partnerships, Plus more.

This package includes the following:

✓......Professionally designed website

✓.....Free Website Hosting

✓......Free Domain Registration

✓ .. Your Own Content

✓......Unique Custom Design

limited time offer!

PAYMENT PLAN AVAILABLE !

7 figures Package support : $15000

now $6750!

GROW YOUR BUSINESS

This package help you you grow your Tax Business with a complete support system

This package includes the following:

✓..Tax preparation course Plus Free Tax Software

✓......Free Tax Software for PTIN Holders (no minimum requirement) for EFIN (7 minimum clients).

✓.....Free Website Design and Hosting

✓.....Marketing intensive offer to you clients to attract more clients at no cost to you

✓.....Your unique Portal

✓..Lead Generation Software Free for 1 years

✓ .....Weekly coach/private group to answer all your tax questions in Tax season

limited time offer!

PAYMENT PLAN AVAILABLE!

Professional Website Design: $2500

now ONLY FOR $999!

FREE HOSTING

Professional Website Design

Your unique online representation

Get your business online for Only $999 with Free Website Hosting, Free Domain Name For Accountants, Bookkeepers and Tax Professionals. Our Premium Deluxe Website Package is the perfect way to launch your online presence in a big way.

For just $999, you'll get a professionally designed website, a custom Free domain name, secure Free hosting, and all the essential features you need to succeed. This package is more than just a basic website - it's a powerful foundation for your digital success.

Fast, Simple and affordable business Website For:

LLC, Corporations, Non-Profits, DBA, Partnerships, Plus more.

This package includes the following:

✓......Professionally designed website

✓.....Free Website Hosting

✓......Free Domain Registration

✓ .. Your Own Content

✓......Unique Custom Design

limited time offer!

PAYMENT PLAN AVAILABLE !

BUSINESS FORMATION & KITS: $1475

now $750!

PLUS STATE FEE

Form a Company

Fast, Simple and affordable business formation for all entity types nationwide

LLC, Corporations, Non-Profits, DBA, Partnerships, Plus more.

This package includes the following:

✓...Filing of Formation Documents

✓ .....Filing Service

✓......Preparation of Articles

✓......Standard Processing

✓.....Preparation of Articles

✓....Employer Identification Number / TAX ID

✓.....Operating Agreement/ OR Minutes and Bylaws For Corporation

✓......Name Availability Search

✓.....Delivery of Filed Documents

✓...Registered Agent Subscription ( Free For 1 years )

✓.....Online Company Management

limited time offer!

PAYMENT PLAN AVAILABLE !

BUSINESS FORMATION & KITS: $1475

now $750!

PLUS STATE FEE

Form a Company

Fast, Simple and affordable business formation for all entity types nationwide

LLC, Corporations, Non-Profits, DBA, Partnerships, Plus more.

This package includes the following:

✓...Filing of Formation Documents

✓ .....Filing Service

✓......Preparation of Articles

✓......Standard Processing

✓.....Preparation of Articles

✓....Employer Identification Number / TAX ID

✓.....Operating Agreement/ OR Minutes and Bylaws For Corporation

✓......Name Availability Search

✓.....Delivery of Filed Documents

✓...Registered Agent Subscription ( Free For 1 years )

✓.....Online Company Management

Purchase Big Boss Complete package Now and get complimentary Hotel stay

Tax Express Pro

Add-on courses:

All courses are in English or Spanish

Annual Filing Season

Program (AFSP): $175

The AFSP is an annual voluntary program for tax return preparers. It aims to recognize the efforts of non-credentialed tax return preparers who aspire to higher professionalism.

The AFSP course contains 10 hours of Tax Law, 6 hours of AFTR, and 2 hours of Ethics. After completing this course with a score of 70% or better, the tax professional will be able to have limited representation rights for their clients. This course qualifies for 18 hours of continuing education. This course includes a 6-hour annual Federal tax refresher course & online test.

Annual Filing Season

Program (AFSP): $175

The AFSP is an annual voluntary program for tax return preparers. It aims to recognize the efforts of non-credentialed tax return preparers who aspire to higher professionalism.

The AFSP course contains 10 hours of Tax Law, 6 hours of AFTR, and 2 hours of Ethics. After completing this course with a score of 70% or better, the tax professional will be able to have limited representation rights for their clients. This course qualifies for 18 hours of continuing education. This course includes a 6-hour annual Federal tax refresher course & online test.

OFFER BOOKKEEPING

SERVICES COURSE: $656

This bundle includes the following:

✓......1- Introduction & Terminology

✓......2- Transaction Receipts and Expenditure Coding

✓......3 - Sales and Use Tax

✓......4 - Payroll

✓......5 - Inventory

✓......6 - Financial Statements

Every tax preparer and accountant somewhere along the lines needs to have a fundamental basic understanding of bookkeeping to ensure they are using the correct numbers when preparing a tax return or otherwise presenting financial information to their client. Unfortunately, due to the inherent complexities, many clients need more preparation and help to complete this task. This 6-part course will take you through 6 main elements of bookkeeping and accounting basics, so you can have confidence that the information is assembled correctly. This course is excellent for anyone assisting you in this capacity to attend to have the best chance of providing accurate financial information.

OFFER BOOKKEEPING

SERVICES COURSE: $656

This bundle includes the following:

✓ 1- Introduction & Terminology

✓. 2- Transaction Receipts and Expenditure Coding

✓ 3 - Sales and Use Tax

✓ 4 - Payroll

✓ 5 - Inventory

✓ 6 - Financial Statements

Every tax preparer and accountant somewhere along the lines needs to have a fundamental basic understanding of bookkeeping to ensure they are using the correct numbers when preparing a tax return or otherwise presenting financial information to their client. Unfortunately, due to the inherent complexities, many clients need more preparation and help to complete this task. This 6-part course will take you through 6 main elements of bookkeeping and accounting basics, so you can have confidence that the information is assembled correctly. This course is excellent for anyone assisting you in this capacity to attend to have the best chance of providing accurate financial information.

Level I:

CORPORATIONS

AND PARTNERSHIP: $875

This level I self-study course will cover the following:

✓......Bookkeeping for tax preparers, payroll, sales tax, depreciation, and amortization

✓......LLCs, Sole Proprietorships, Partnerships, and Qualified Joint Ventures

✓......C-Corporations

✓......S-Corporations

Level I:

CORPORATIONS

AND PARTNERSHIP: $875

This level I self-study course will cover the following:

✓. Bookkeeping for tax preparers, payroll, sales tax, depreciation, and amortization

✓ LLCs, Sole Proprietorships, Partnerships, and Qualified Joint Ventures

✓ .C-Corporations

✓ S-Corporations

Level II:

CORPORATIONS

AND PARTNERSHIP: $875

You must complete Level I to take this course as it contains previous examples.

This level II self-study course continues with the following:

✓......The taqueria is in the second year of business and has a loss. What do you do with a loss on the tax .........return?

✓......Find out how and where to report reimbursements for an accountable plan, paid medical insurance for .........shareholders, dividends from retained earnings for shareholders for the C-Corp, and partnership .........expenses for the S-Corp and Partnership

✓......Other topics covered will be Net Operating Loss (NOL) carryback, effect in basis for S-Corp, and .........Partnership non-deductible expenses and donations.

Level II:

CORPORATIONS

AND PARTNERSHIP: $875

You must complete Level I to take this course as it contains previous examples.

This level II self-study course continues with the following:

✓. The taqueria is in the second year of business and has a loss. What do you do with a loss on the tax return?

✓. Find out how and where to report reimbursements for an accountable plan, paid medical insurance for shareholders, dividends from retained earnings for shareholders for the C-Corp, and partnership expenses for the S-Corp and Partnership

✓. Other topics covered will be Net Operating Loss (NOL) carryback, effect in basis for S-Corp, and Partnership non-deductible expenses and donations.

If you would like to speak to someone before making a purchase, schedule an appointment now.

We respect your privacy. Your information is 100% safe with us.

If you would like to speak to someone before making a purchase, schedule an appointment now.

We respect your privacy. Your information is 100% safe with us.

Refer three people and receive a complimentary hotel stay.

Tax Express Pro

Click the button below to request a Demo of TEP today!

Tax Express Pro

Frequently Asked Questions

1 - Will the Tax preparation course be reported to IRS for Continuing Education (CE) credit?

Answer: Yes, it will. It is 10 hours of Federal Tax Law and 2 hours of Behavioral Ethics. You will receive a certificate of completion at the end of the course. We also offer Annual Filing Season Program (AFSP) classes.

2 - Does the software include business and State returns?

Answer: You will have access to all 50 States 1040 professional tax software!

3 - Do you offer bank products with a cash advance?

Answer: Yes. Our packages include bank products and up to $7000 cash advance per filer.

4 - What if I want if I do not want to use bank products?

Answer: If you don't use our bank products, you will have to pay $50 to e-file only for PTIN holders others PTIN/EFIN $25.

5 - Can I transfer last year's data to the new program?

Answer: Yes. Our software support team will help you transfer your clients' data into the new tax software.

6 - Can I set up my own price?

Answer: We already set some base price for common forms into the software, but you can adjust them up or down by using some of the discount or add on fees.

7 - Do you provide marketing materials?

Answer: Yes, we will send you some digital marketing materials that you can use to promote your tax business.

8 - How soon can I have the software after purchase?

Answer: As soon you have completed all the onboarding forms, you will have access to the software the same day or next business day!

9 - Can I get the Tax Software demo?

Answer: Due to high demand we're not offering a demo of the software at this time. We can give you a link to our webinar that gives you a complete overview of the platform , how it works, key features, and how you can get started quickly. You have nothing to lose Free Software!

© 2024 Tax Express Pro - All rights reserved.